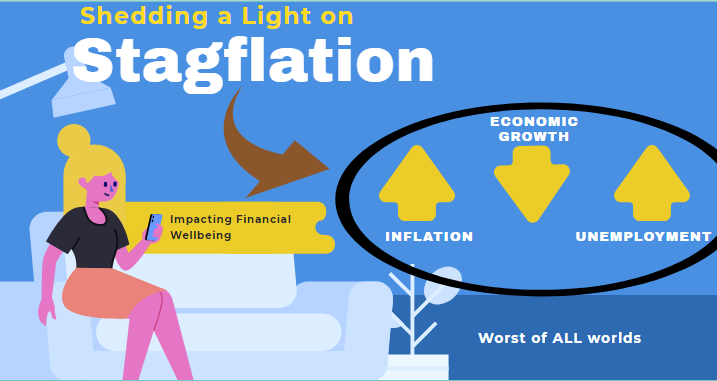

Inflation can have a very negative impact on family finances and general financial wellbeing. To counter its impact, it is important to understand what it is and how it can be managed.

Inflation can have a very negative impact on family finances and general financial wellbeing. To counter its impact, it is important to understand what it is and how it can be managed.

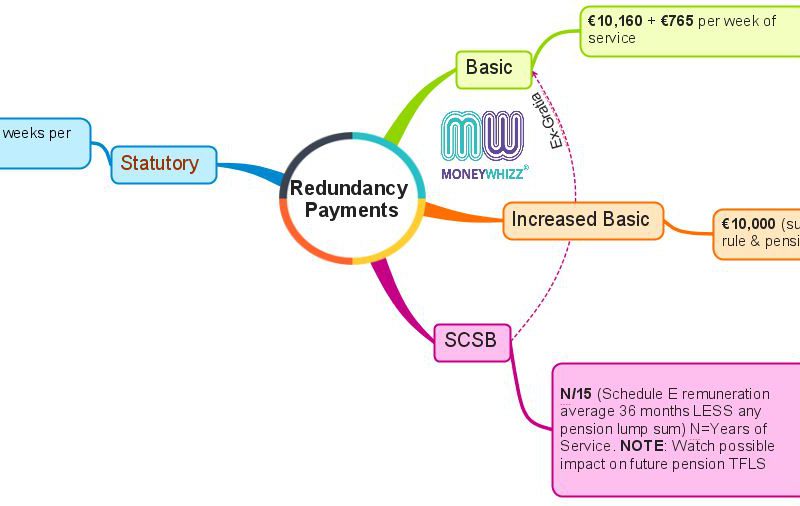

Redundancy represents a major life event for those impacted. To add to the complexity of the financial challenge, those affected often report feeling overwhelmed by having to consider complex financial decisions at the same time, without personal expertise or professional support.

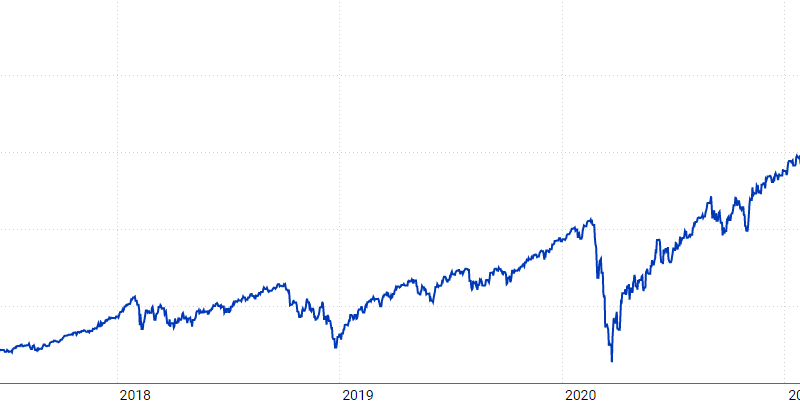

Stock markets underpin so many investments in modern financial planning. As we now enter a period of robust volatility, it is important to keep things in perspective.

In mid-2020, the US Federal Reserve, under the Chairmanship of Jerome Power announced a significant shift in monetary policy. It said that in order to drive a recovery in the…

Prospect of rising mortgage costs next challenge for families The weekend call by the head of the Dutch Central Bank for a rise in interest rates could not have come…

Embargoed 00:01am Monday February 7th 2022 Financial well-being is broadly defined as having enough money to pay for everyday expenses, a little extra for enjoyment, save for the future and broadly,…

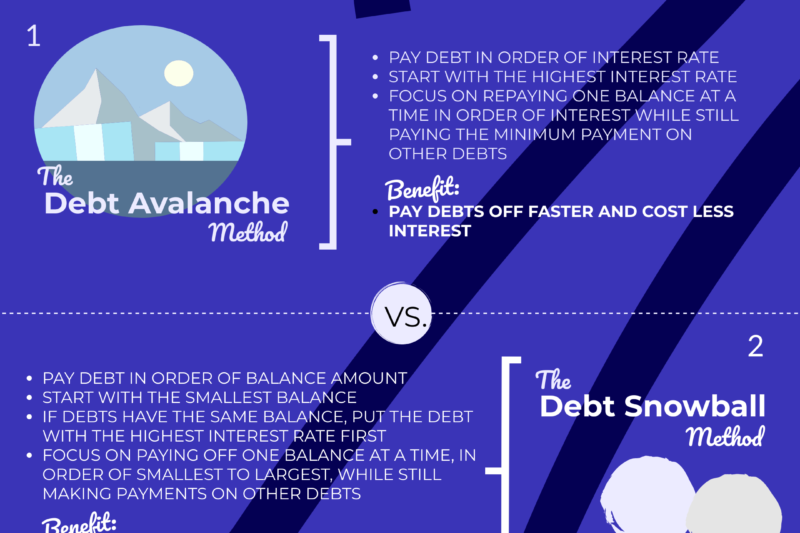

Paying off debt is no easy task, especially if you pay just the minimum amount due each month. Using the example of a €500 credit card balance, if the rate…

January can be a difficult month financially for many people. But the dark evenings can be put to good use that can prove beneficial.

How the tax system operates can be intimidating for lots of people. However, over the years, Revenue has been making it easier for taxpayers to apply for a whole range of tax refunds, tax relief and tax credits. Make 2020 the year you take tax back from Revenue, after all, they want you to take back what is rightfully yours!

As it becomes easier to shop and spend from the comfort of our homes, saving money needs to be easier too. There are some practical ways to automate savings and reach your financial goals.

While 2022 is just around the corner, some risks to our financial wellbeing are already here. Inflation, stock market valuations and even interest rates are all in the spotlight and all three have the potential to inflict some financial pain. But it is possible to plan ahead and protect your personal financial wellbeing.

There are many DIY investing platforms available today. They offer quick market access and the potential to build personal investment portfolios. But are they the ideal solution for novice investors?

With little over a month to Christmas Day, this is an ideal time to take stock and prepare. Getting a head start on your shopping can mean less pressure, stress,…

People are being presented with an increasing number of options when it comes to investing. Some offer a robust do-it-yourself approach. But just because you can go the DIY route, should you?

If you’ve been fortunate enough to have enjoyed a little extra money in your account since working from home, don’t let returning to the office cause a relapse of old spending habits. By putting a simple plan in place, you can boost your savings.

From a personal finance perspective, were stagflation to take hold, it would have a very significant and negative impact on the value of money held in savings, income, pension payments and even employment prospects. As inflation erodes the buying power of money, the real value of money held on deposit falls in tandem with the prevailing rate of inflation.

In today’s world of complex money concepts, it is essential to have a grounded understanding of how it works. This is really important from a broad financial wellbeing perspective.

There is a growing demand for a more ethical approach to how companies are managed. Investors want to see that their money is invested wisely, in companies that care for their workers, society and the environment.

The latest moves by Chinese authorities to ensure tech firms based there are in full regulatory compliance has impacted stock valuations. This can have far-reaching consequences, especially when it comes to pension funds.

Climate change is happening and its impact on our personal finances is becoming clearer. For many, it will mean more cost for insurance, fuel, food and also, is likely to impact our financial wellbeing in retirement.