Recently, an article in Bloomberg presented a series of startling figures from the US where members of the public suggested how big their retirement pots should be. With little evidence, their pulled-from-the-sky figures ran into millions.

The rise of defined contribution pensions

Across the globe, the rise in defined contribution (D.C.) pensions means the public now carry the main burden of responsibility for their financial wellbeing in retirement. When defined benefit (D.B) pensions were the norm, this burden was carried by the employer. Even where there are career average defined benefit (C.A.D.B) plans in place, most of the responsibility still rests with the employee.

Getting the base numbers right

Every pension plan should begin with the financial expectations of the individual. This can be achieved by establishing the cost of running a household and having some additional financial capacity. Factoring for the State pension which currently pays out about €14,000 per year (to those with full PRSI contributions), private pension calculations should be designed to fill any financial gap.

There are 8 variables that must be factored into any retirement calculations.

- The base number – this is the primary figure at the centre of any good retirement plan. It needs to factor in the cost of food, fuel, insurance, social life and whatever else one spends their money on. So, even though a person may pay off a mortgage and dependent children may become financially independent, the cost of living in retirement is not cheap. For example, health costs, even where one has health insurance and home repair can increase in retirement as both people and homes age and may require extra care and attention.

- Inflation – while this is running at exceptional levels currently, it is expected to decline over time. So far, it is unclear how long it will take to return to the target rate of 2%. But if it were to hover at 2.5% or 3%, this will have a considerable impact on retirement planning calculations.

- Money manager costs. While Ireland has a range of measures in place to limit some management costs, there are also other fees and charges that will impact and erode the overall fund growth potential of any retirement account. By some measures, Ireland tends to be expensive on this.

- Years to retirement – it is important to start early. Doing so enables the future retiree to carry greater investment risk and possibly higher rates of fund growth for their retirement needs. It also means they benefit from more tax-free investment returns and more Government-funded tax relief on contributions. Where they are contributing via an employer sponsored occupational pension scheme, they will be benefitting from more employer contributions too!

- Investment growth – the rate of investment growth achieved by a pension fund will play a major role in final pension fund value. This will underpin the beneficiary’s income in retirement.

- Percentage of salary – the Irish State is incredibly generous when it comes to allocating a percentage of our gross salary to retirement planning. Someone in their twenties can allocate up to 15% of their gross salary towards their own retirement account. This percentage increases as one ages with higher limits for those in their 30’s, 40’s and so on. And with AVC’s and backdating of pension contributions, there is a lot of flexibility to taking maximum advantage. With tax relief, this means for every €100 put into a pension, it only costs €80 or €60 depending on one’s marginal rate of tax. Where someone enrols in an employer sponsored occupational pension scheme, the options to accelerate pension fund growth multiply.

- Wage growth – this is also a major factor and although there may be career advancement and wage bonus opportunities, it is often safer to assume for about a 1.5% – 2% rate of wage growth.

- Current pension fund value – this is an important factor regardless of what career stage one is at presently. For someone starting out, their retirement fund will be €0 but others in mid-career may have an existing fund. Either way, it’s another piece of an important financial calculation for retirement planning purposes.

- State benefits – there is a nineth variable. Most people should expect to qualify for the maximum State pension, but some may not. In some cases, if they have worked outside of Ireland, it is possible they may not have sufficient PRSI contributions to qualify. If so, they should explore if they can combine work credits from abroad here in Ireland. Perhaps they qualify for a state pension in another state. Either way, if their PRSI contributions here in Ireland are in any doubt, they should be having a conversation with the relevant authorities at least 2 years before they retire.

Putting some figures together

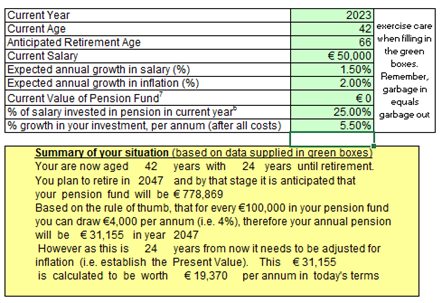

42-year-old example – taking the example of a 42-year-old with no private pension fund presently, this is how their numbers stack up. First, they earn €50,000 and hope to have an income in retirement that is equal to two-thirds (66%) of that income. They will receive the full State pension. To make the figures relevant for today’s calculations, the final estimate factor for inflation and are presented in present value amounts.

- Present income – €50,000

- Retirement needs (66%) = €33,000

- Less State pension €14,000

- Target annual income from private pension €19,000

With retirement age set at 66, this 42-year-old needs to do the following.

- Invest 25% of gross salary (this is the maximum allowed for a 42-year-old). However, if the employer contributes some equivalent amount, say 5%, this eases the contribution burden a little (where there is an occupational pension scheme option).

- Achieve a 5.5% annual rate of investment growth.

- Receive a 1.5% rate of wage growth.

- Inflation must return to 2%, if it is higher, then the 42-year-old needs to adjust their plan. This could mean reducing their financial expectations in retirement or finding a way of increasing their fund growth.

56-year-old

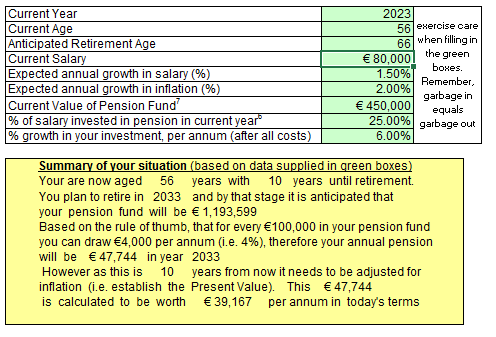

In this example, the person is currently earning €80,000 per year. They want to have an annual income in retirement that is equal to two-thirds (66%) of their present salary. This means they need to have €52,800 coming in. When the state pension of €14,000 is factored in, this means the net figure required is €38,800. To achieve this, they will need a substantial pension fund already (€450,000), a sizeable annual contribution (25%) and strong rate of fund growth each year (6%). This approach should deliver an income of €53,967 or 67.45% of their present income.

It all depends.

Of course, pension planning is only as good as the available information at the time. It is not unusual for some people to never have the financial capacity to save this way. In such cases, what is important is they know what their bottom-line figure is. For most people, the state pension is the starting point. If they are married, their spouse will almost certainly have a state pension entitlement too. Or, if a spouse has a private pension fund, or access to a DB pension, it all needs to be factored into the bottom-line figure. Equally, if they expect to receive an inheritance in the future, it all forms part of their future retirement income.

On the expense side, perhaps they can reduce costs?

Ultimately, retirement panning should be built around the specific financial needs of the individual. Unfortunately, there is no one-size-fits-all figure that is suitable for everyone. Regardless of the financial capacity of the individual, having some extra funds for retirement will always serve them better than having none at all. So, even if they save a little, it can make big difference to their financial wellbeing in retirement.

Frank Conway is a Qualified Financial Adviser and founder of MoneyWhizz.org, the financial literacy initiative. Calculator courtesy of Ablata.

Comments are closed.