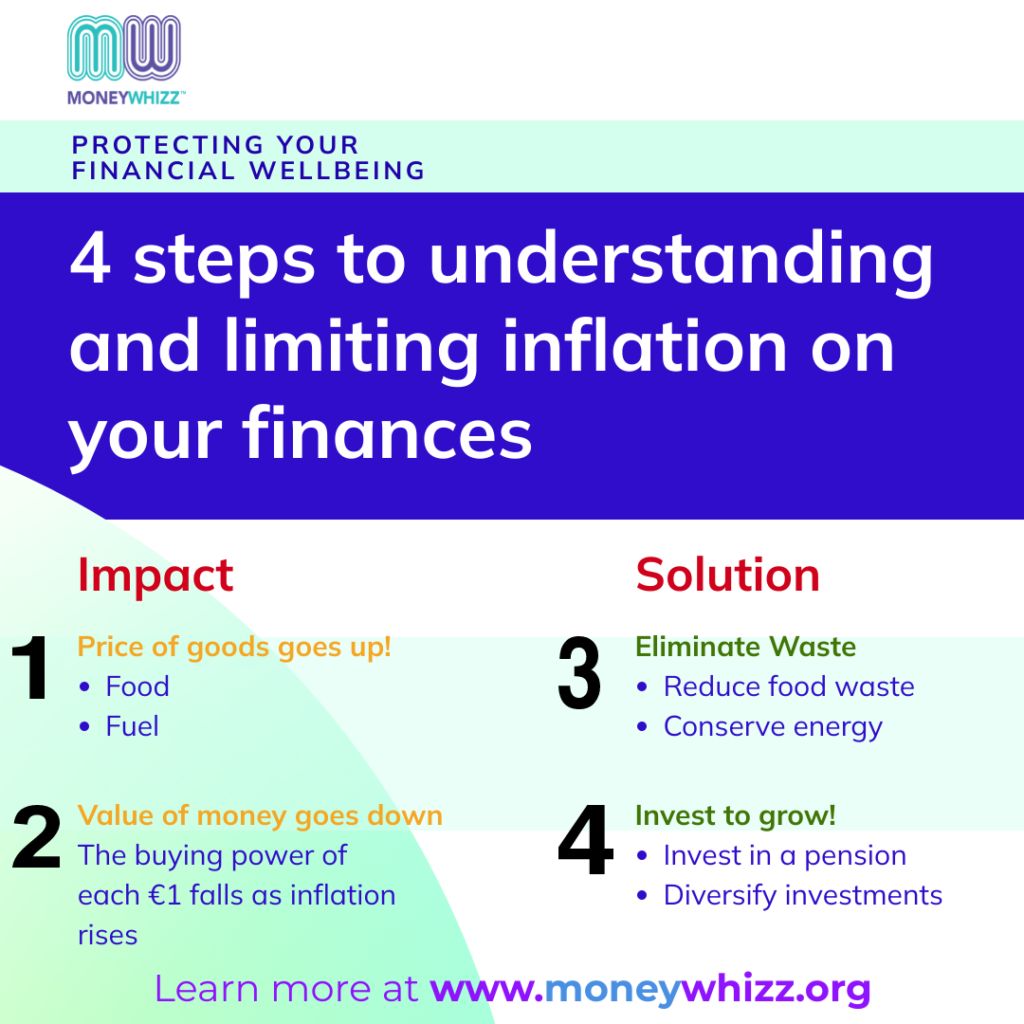

The arrival of inflation into the daily lives of the population has been sudden and extremely sharp. The rising cost of everyday basics such as electricity, petrol and food are stark reminders of how inflation impacts household budgets and day-to-day financial wellbeing.

Inflation hits us all in two ways. First, it impacts when prices rise. But there is another side to inflation that is equally damaging: over the long-term, it erodes the purchasing power of money. So, in the short term, it means that we need to spend more money to buy the same basket of groceries. But, over the long run, it means that calculations and assumptions we may have used to plan for retirement are somewhat redundant.

Taking back control – in the short term, in respect to items like food and fuel, some behavioral changes to how we consume may offer some respite. For example, it is estimated that food waste in Ireland costs each household in the region of about €700 per year. Surely, this is an area that can be examined more closely. Additionally, how we manage fuel usage can also be examined more closely. With more and more people returning to work, schemes that include bike-to-work and tax-saver are ways to reduce costs. And finally, when it comes to the long-term value of money, instead of leaving money on deposit, some investment will be needed to retain buying power. This can be done very tax-efficiently through any of the many pension options available in Ireland (workplace schemes and PRSAs). In the non-pension space, look to diversify through any of the many fund options available (including ETFs).

Comments are closed.