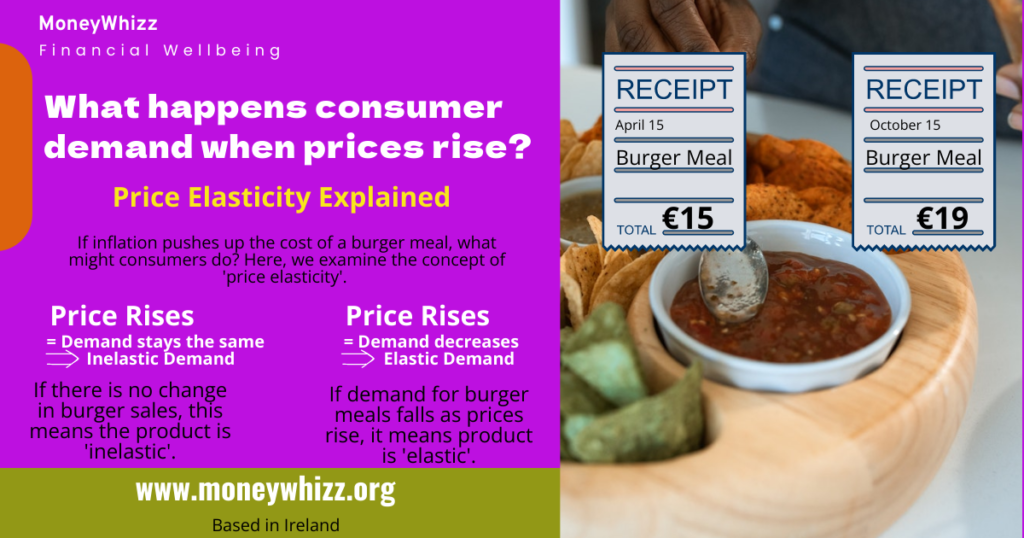

Elasticity is an economic concept used to measure the change in the overall consumer demand of a good or service in relation to price movements. In other words, what happens to demand if prices go up or down?

A product is considered to be elastic if the demand for the product changes more than proportionally when its price increases or decreases. Conversely, a product is considered to be inelastic if the quantity demand of the product changes very little when its price fluctuates.

For example, insulin is a product that is highly inelastic. For people with diabetes who need insulin, the demand is so great that price increases have very little effect on the quantity demanded. Price decreases also do not affect the quantity demanded; most of those who need insulin aren’t holding out for a lower price and are already making purchases.

On the other side of the equation are highly elastic products. Going out for a burger meal or spa days, for example, are highly elastic in that they aren’t a necessary good, and an increase in the price of trips to the spa will lead to a greater proportion decline in the demand for such services. Conversely, a decrease in the price will lead to a greater than proportional increase in demand for spa treatments.

Putting it to the test

As inflation continues to take hold and accelerate, it will be interesting to see which products and services are elastic or inelastic. For example, the rise in home delivery services or food. Will demand for the delivery aspect of the service remain the same? Or how about dining out? As prices rise, will we witness consumers cutting back? More fundamentally, what will the impact of surging fuel prices have on family budgets? Will householders continue to heat their homes at the rate the may have done in 2020 or 2021? Of course, householders and consumers in general will be constrained by their incomes so in the end, cutbacks will have to happen.

Winners and losers

a sizable proportion of those in their 30’s and 40’s would now struggle to give either a wedding or birthday gift.

MoneyWhizz Consumer Financial Resilience Report 2022

Despite the latest Central Bank report showing savings rates in Ireland still being very healthy, the inflationary drain is already having an impact. A consumer report from MoneyWhizz revealed that a sizable proportion of those in their 30’s and 40’s would now struggle to give either a wedding or birthday gift. Plus, rising mortgage repayments are now beginning to kick in so the drain will only accelerate in the months ahead. How this will impact retailers will begin to become much clearer in the months ahead.

Comments are closed.