When it comes to saving and investing your money, there is a lot more choice in the Irish market than was the case even half a decade ago.

But first, a little housekeeping.

Saving money is not investing. Investing is not saving. And what I mean by that is the level of risk and potential for return for either option is very different.

Saving

Saving money is all about minimising risk. So, when people save money, what they really want to know is if that money is safe from loss. And here is a key point, it is loss of capital but it should also include loss of buying power. This is why so many people ask if their money is ‘safe’ before they ask what the rate of return might be. The primary instinct is always to protect the cash.

Investing

With investing, risk and return are intertwined. But it is important to also understand the difference between investing and speculation. Investing is generally seen as less risky and calculated where the primary focus is to generate a positive rate of investment return over a period of time. Speculation is often very short term and bordering on gambling, where there is a far higher risk of capital loss than would be expected on an investment.

But with investing, it should be for a period of 3 years or more. This is to ensure that investment market fluctuations (such as the stock market price rises and falls) are factored in and evened out over time.

So, where to save and invest right now.

When it comes to savings, there are now online banking options as well as the more traditional banks offering some decent rates of return presently. Those include:

Online savings brokerage Raisin and the traditional Irish banks are all actively promoting their offers to Irish savers. Here are some examples:

- Banco Português De Gestão 4.1%

- TEF Bank – 3.65%

- BFF – 3.5%

- BluOr Bank – 3.45%

- Lightyear – 3.25%

- AIB – 3.02%

- PTSB – 3%

Some of the options available only through Raisin Bank

So, the general direction of interest rates on offer are in the 3% – 4% range. However, once DIRT at 33% is factored in, net earnings are coming in at about 2% – 2.7%. This is still marginally better than the top yield on the State Savings which pays 2% (2.01%) on the 10-year bond (Issue 9).

With some of the pan-EU banks, savers just need to be aware that Irish DIRT limits still apply, regardless of what the equivalent tax is applied in the banks home country so any difference will need to be reconciled.

Factoring for inflation

The bottom line is savers in Ireland will still struggle to maintain the value of their money against the impact of inflation, even if they manage to secure the best rates. So, while savers can protect their capital through the Deposit Guarantee Scheme, where inflation is elevated, they will struggle to protect buying power.

Investing

When it comes to investing, there is more opportunity to invest than was the case a decade ago. Online brokerages have changed the investing landscape here significantly. That said, accessing investment options is one thing, knowing where exactly to invest is another.

The basic rule of sound investing is diversification. And a proven method of doing so is through diversified portfolios. Over the course of the last few decades, the rise of Exchange Traded Funds have become a diversification favourite. Similar to Mutual Funds, ETF’s are organised and traded a little differently and generally, are more cost effective from a trading and management fee perspective. But the real purpose of ETF’s (as well as Mutual Funds) is market access and diversification.

There are many firms that trade in this space. If we take the product offering of one the leading global players in the low-cost ETF space, Vanguard, while they offer their funds directly to the public in the UK and US, this is not the case here in Ireland.

Taxation that is applied on investment funds, including ETFs is complex and expensive in Ireland. Because of this, global ETF leaders end up becoming less accessible and more expensive to individual investors who are forced through broker channels as a result. Brokers need to earn a living and their costs are added on!

Incidentally, from a tax perspective, it is less expensive and more straightforward to invest in higher risk cryptocurrencies in Ireland than it is in ETFs.

However, it is still possible to access Vanguard funds (as well as many more) via the online and regular brokerage services. These include DeGiro, Bux, eToro just to name a few. Some of the newer online brokerages offer a no-fee or minimal fee service.

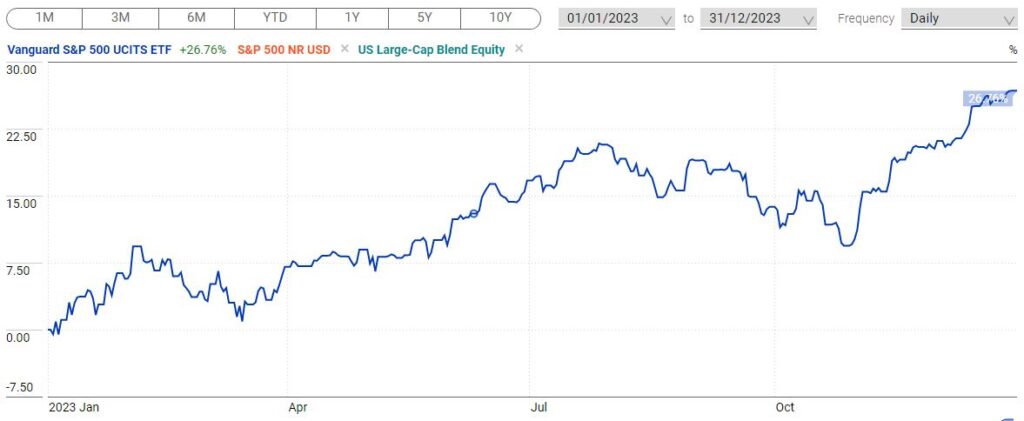

So, if we look at a Vanguard fund, Vanguard S&P 500 UCITS ETF, it grew by a whopping 26.7% in 2023. That means if you invested €20,000 at the start of 2023, by year-end, you would have earned €5,340. Deducting the 41% tax and factoring for the tax-free €1,270 allowance, the net earnings would be over 18%. However, the rule when it comes to investing is to allow time. Over the past number of years, growth has been a little rocky. For example:

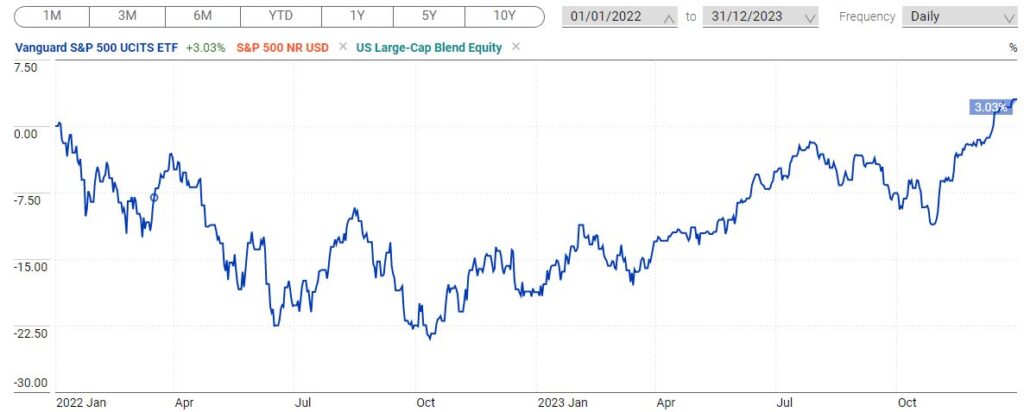

Between January 1, 2022 and December 31, 2023, the same ETF rose by just 3.03%

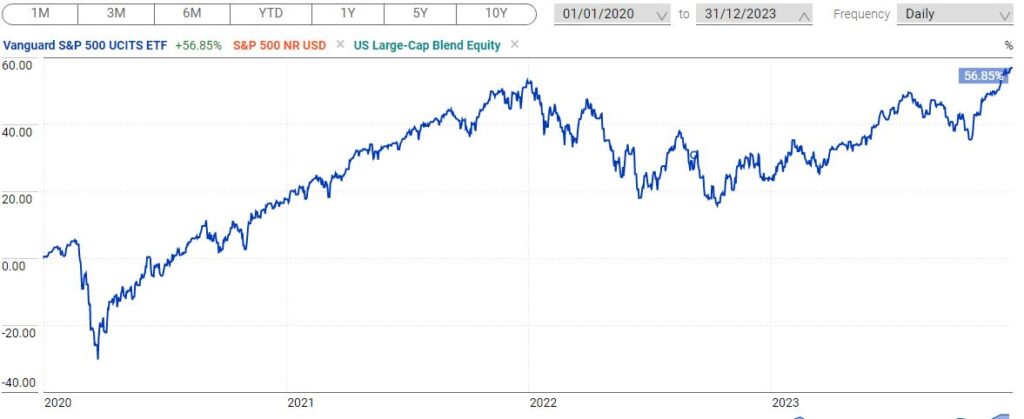

But, from January 1, 2020 and December 31, 2023, it has risen by 56.85%

Inflation impacted a lot of company stock prices, which in turn impacted underlying valuations. However, as inflation abates, valuations are slowly returning. This also reinforces the critical point of time in the market. Investing requires planning and patience. Allowing for an investment period of 3 years or more should allow the impact of global events to play out, as appears to be the case now with inflation.

Taxation

ETF’s (and other such funds) are subject to some extraordinary levels of taxation in Ireland. With a tax-free allowance of just €1,270, gains are taxed at 41%. This causes tax-shock to would-be investors and often, they choose to bow out. In fact, due to generally lower levels of financial literacy in Ireland, the natural tendency of would-be investors is to focus on the facts they can easily comprehend and avoid terminology they don’t. So, with investing, the 41% tax trumps the potential for significantly higher rates of returns.

Pensions

These continue to be the darling of saving and investing in Ireland for many people. And with extremely generous tax relief in place for those that enrol in either company-sponsored schemes or standard PRSAs, who can blame them. And it is not just the tax relief, or the company match on contributions. Where the real magic of pensions lies is in the tax-free growth of funds…there is no tax applied up to allowable limits. Compared to other options available in the Irish market, pensions are a no-brainer for those with access to them.

Frank Conway is a Qualified Financial Adviser and Founder of MoneyWhizz.

MoneyWhizz is a financial education resource that aims to inform how personal finance works. The services of MoneyWhizz are available through leading employers. Users of this website should seek independent financial advice on matters of personal finance. You can contact the author at info@moneywhizz.org

Comments are closed.