Q. As equity markets take a battering, I am really concerned about my investments and my future pension pot. Should I sell up?

A – There is no doubt that investment valuations are taking a beating at the moment. Over the course of the last few years, as investors (retail and institutional) sought out returns for their cash, the stock market was one of the places it found a home. So, valuations grew at some extraordinary rates resulting in some extraordinary rises in many stock market indices (S&P, Dow Jones, Nasdaq, FTSE).

However, in recent months and especially since the start of 2022, a confluence of events has taken hold.

First, the rise in inflation means that central banks are taking notice and acting by increasing interest rates. While the European Central Bank has not increased the base lending rates yet, it has signalled a willingness to do so at some point, possibly later this year.

Second, the rapid escalation of tensions on the Russia and Ukraine border adds a very unknown variable into the global investment landscape, especially when it comes to oil, gas, and a whole range of other raw materials.

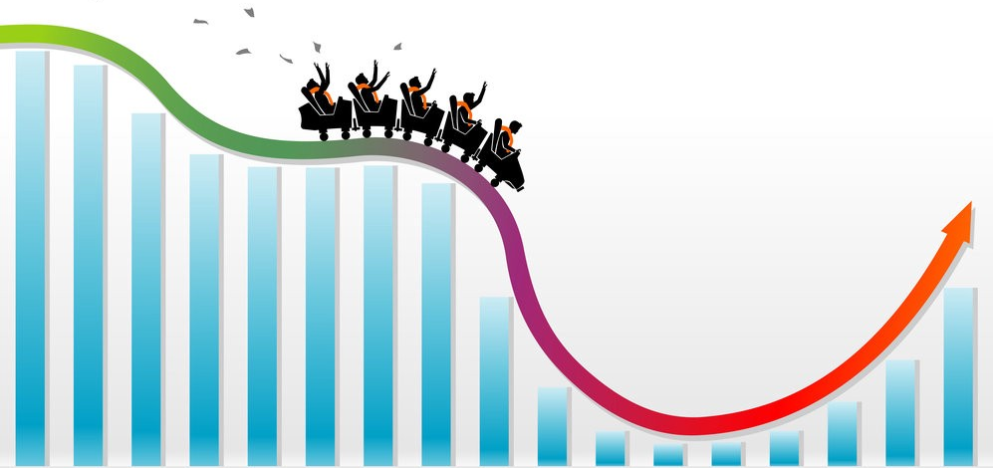

Pension and non-pension investments are being hit as a result. However, this is a time to reflect on the historical behaviour of equity markets during periods of extreme volatility.

If we take the S&P 500 index, it can be tracked all the way back to 1926. So, with almost a century of data, comparing price valuations, it shows the average annual rate of growth is 8% + However, there are periods of extreme loss. These include the period between 1929 – 1932/33. 1973 – 1975. 2001 – 2002 and again 2008 – 2010. 2020 was also a year marked by temporary and extraordinary loss at the onset of the pandemic but markets quickly recovered.

The lesson today is that using past performance as a broad guide, market volatility is probably going to settle down. Of course, the rate of market growth is another issue entirely. Since 2012, there have been some extraordinary rates of yearly valuation growth, which some experts predicted and were as a result of record low interest rates. As monetary policy tightens, market valuations are likely to be less rewarding but rewarding none-the-less for those that are prepared to stay the course.

Ultimately, investments should be long-term in nature. For someone nearing retirement where they will be wholly dependent on their pension investments, de-risking is a must. For anyone with a lot of time on their side, using the past as a guide, the current market volatility, while uncomfortable and unsettling, is also likely to pass.

Comments are closed.