By Frank Conway

Who said education is free? In Ireland, education costs can be significant, While the general cost of paying for the educators is paid for through general taxation, there is a wide set of education costs that need to be understood and factored for in advance of a child starting or returning to school, including the many different education costs.

For example, the general back-to-school costs associated with primary and secondary school are as follows:

What parents need to know about education costs

According to the most recent set of statistics provided by Bernardos, the children’s charity, the many education costs associated with sending a child to school in 2019 remains substantial across primary and secondary school. For example, it reveals the average cost of the basics needed for a senior infants pupil is €340 whereas when it comes to a fourth class pupil, that cost rises to €380 and increases again to €735 for a first year pupil in secondary school.

While the cost of returning to primary and secondary school has been a topic of concern for parents with pupils in primary and secondary school, they continue to cause considerable financial stress for many.

How some parents pay for education costs

For example, according to the most recent Bernardos admit they forgo paying bills and cut back on other costs to meet the costs of returning to school:

42% of primary school parents and 47% of secondary school parents.

Getting into debt for education

Worryingly 8% of primary and 14% of secondary school parents say the costs means they have no choice but to borrow money to cover school costs.

Costs that need to be accounted for…and paid for

Some of the items that incur significant costs include:

School books – 51% of primary school parents and 46% of secondary school parents reported an increase in the cost of school books in 2019.

School “voluntary” contributions – despite a 5% increase in capitation fees parents are still being asked to pay a voluntary contribution with 67% of primary school parents saying that have been asked to make a “voluntary contribution” and 69% of secondary school parents have been asked to pay a contribution.

Uniforms – this continues to be an area of significant cost with 75% of primary and 95% of secondary school parents reporting they are required purchase crested uniforms.

What parents say

According to some parents I have engaged with in company seminars, it is not uncommon for back to school costs to reach €1,000 – €1,500 depending on they having a combination of primary / secondary school going children and includes a mix of essential costs and also, extra curricular activities.

College increases significantly

Third level education costs!

What is of even greater financial challenge to parents is the cost of college and this varies by between €6,500 and over €12,000 according to the most recent information from a number of studies (TU).

Covid confusion but don’t bet on a bargain!

What is not immediately known at this point is how costs will be impacted by Covid-19. For example, we don’t yet know how much study-at-home requirements will replace commuting and remote accommodation costs. However, we do know that Universities and Colleges, regardless of whether they provide educational resources online or in-class will have only limited capacity to reduce the real cost of education significantly so the fees that are present today are likely to be present in the future.

Having an idea of the broad breakdown of expenses

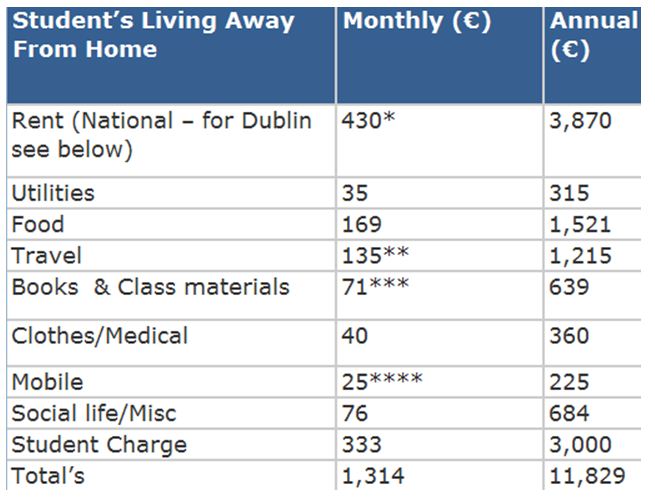

Recently, I worked with a couple based in Clare where their son was attending college and living away from home. As part of the budgeting exercise, the following costs were discussed:

What we were looking to achieve was a monthly and annual budgeting system that the student could factor in from a spending perspective.

Avoid getting caught short

What we were looking to achieve was a sense of financial awareness so that the student would not be caught short for money closer to exam time…when they needed to be really focused on their studies. Financial stress can have a really damaging impact on adults and for students; a world with money running out can be an extremely stressful period.

So, this exercise was designed to create:

- Awareness of the costs involved

- A system of monthly budgeting

- An early warning system in the event they needed some parental support, or to seek out employment or even consider applying for a loan.

Covid cash crunch

Of course, a major consideration for all 3rd level students and even those in secondary school is the ending of much summer / seasonal / part-time work in 2020. How long this lasts but since a high degree of summer work is dependent on seasonal factors, especially tourism, it is a highly uncertain time for those hoping to return to some form of ‘normality’. Without this income source, budgeting is more important than ever.

Inclusive financial considerations

From a long-term college cost issue, the best course of action is to assume for costs based on the information we have available today. This means parents should continue to plan for a range of costs and save accordingly. And as they do so, they should include their teenage students bound for college in the financial considerations.

Take the gradual approach

Regardless of whether parents are planning for pupils returning to primary or secondary school or some more significant financial costs for 3rd level, in all cases, the approach is broadly the same:

- Understand the cost – as with any long-term plan, it is essential parents know and plan for the costs involved.

- Identify the household’s financial capacity – this is a key part of planning ahead. For some families, there may be very little financial capacity to save and this can happen for any number of reasons. But it is important to establish this fact in advance. Doing so can position parents to prepare. It might mean shopping for value much earlier in the summer.

- Look to save a little at a time – small amounts of regular savings can add up over time. For example, if one’s goal is to save €1,000 then if the goal was to save that €1,000 over a 3-month period, this would work out at approximately €11 daily for 90 days. This may be too much for some families so in such cases, they could consider reducing the daily amount saved or increasing the time to save…for example, instead of saving over 90 days, examine if they could save €1,000 over 120 days (or 4 months).

- Borrow cautiously – borrowing is often identified as an option for some families so it is important that where they do choose this option, they get the best value for money. worryingly, some families have in the past reporting using moneylenders. While there are licensed moneylenders operating in the Irish market, the interest rates they charge can approach almost 200%. Parents should take the time to explore as many of the loan options available to them and seek out the loan options with the lowest APR – this is the real measure on the cost of credit.

Other points to consider for back-to-school and college costs:

Long-term planning – this is key to meeting the various costs, especially for those with student attending a third level institution. For some parents, the process of saving can begin when their children are born or enter primary school. Such an early start has a number of advantages including the relative cost of incremental savings in respect to overall household budgets which will be far lower than for those who begin saving much later. Also, for some parents, the early start means that they can have some flexibility to defer savings if and when they need to for any number of reasons, including changes in work patterns, income or simply taking time out of work for family reasons.

Factor for inflation – while it is difficult to predict the absolute cost of attending a third level institution 10 or 15 years into the future, a good rule of thumb is to apply a 2.5% rate of inflation. So, if one is planning for their child’s third level education which starts in 15 years time, assuming for an annual cost of €12,000 (this is the living-away cost) and factoring for a 2.5% rate of inflation, in 15 years time, this works out to about €17,300 annually. This is the final cost parents need to save towards.

Explore scholarships – where students may have some exceptional talents, in academic studies, arts, musical talents and sports, it is sometimes possible that those talents are highly prized by various colleges and universities here in Ireland and abroad. It’s something to keep in mind, although it should not be the only plan parents put in place!

Grants – these are still an option for many parents where they can demonstrate they qualify.

Loans – this is also an option for both parents and students. In such situations, in order to qualify, various qualifying criteria typically apply, including a satisfactory credit check and ability to repay. Loan guarantors may sometimes be required, especially in the case of students applying directly to a lender.

Regardless of how one plans to cover the cost of a third level education or indeed back to school costs for primary and secondary school, planning ahead is really important. But is also essential that parents and students are aware of various other options, including loans, grants and scholarships as they consider their options. Each will require a specific focus but as this article has highlighted, in each case, attention to personal budgets and detail is a consistent component to long-term success.

When it comes to budgeting, use our family budget planner to help you along the way to making informed financial decisions.

Comments are closed.