Capital Gains Tax on Shares in Ireland

Ireland does not have a particularly strong tradition on the purchase and sale of equities (shares). And, where it does, it can sometimes be in a relatively narrow band of companies in a relatively undiversified range of activities. This has sometimes made equity investing highly risky and susceptible to losses.

Additionally, access to buying and selling shares in Ireland was almost done on a privileged basis where a ‘stockbroker’ was the only route to doing so. Here, meeting the stockbroker was presented as a privilege and in hindsight it was more about how much money the stockbroker could make from you than for you.

Today, gladly, the stockbroker does not hold the quite same power to market access they once did. However, their expensive and sometimes, unsavoury, predatory legacy lives on. Many people remain suspicious of the entire investing landscape.

Ireland continues to be more a country of savers than investors. And even where investing does happen, it is often more speculative than analytic where ‘gut’ overrides analysis of operating profits and long-term projections.

Gladly, and thanks to EU market access rules and arrival of low-cost trading platforms share investing is more common than it was in the past. Additionally, the introduction of employer-based share purchase schemes (both ‘approved’ and unapproved’) means more people have exposure to share-ownership now.

That said, there continues to be a broad lack of knowledge when it comes to understanding, declaration and payment of taxes.

Capital Gains Tax

Capital Gains Tax is 33% and is applied where someone has made a profit on the sale of a share.

One unusual exception is ETFs / Life-wrapped investment funds (also referred to as mutual funds or UCITS). Here the tax is 41% and unusually, can be applied even if the owner does not actually sell to realise a profit. But in general the 33% CGT applies.

Example

If someone buys €10,000 worth of shares and sells those same shares for €20,000, it means there is a gain of €10,000. There is an annual allowance of €1,270 (Revenue allows you a small tax-free profit), it means that the actual profit, in this case is €8,730 (€10,000 – €1,270).

The Capital Gains Tax in this case is €2,880.90 (33% of €8,730).

Ireland compared to other countries

For employees of US-based multinationals, the tax treatment of both approved and unapproved share options is vastly different in Ireland that it is in the US. The tax-free amount allowed in the US can be more than 40 – 70 times greater compared to what is available in Ireland. For example, if an employee in Ireland receives company shares and holds them for 3 years and then sells them, realising a gain, their tax-free allowance is €1,270. Someone in the US in a similar situation could have a tax-free threshold of between US$44,625 US$89,250 (2023 figures).

Additionally, where tax does apply, Ireland’s Capital Gains Tax of 33% is far higher than the 15% and 20% amounts payable in the US.

Even in the UK, where there are many similar tax treatments to Ireland, on share sales, the tax-free threshold is UK£6,000 (it had been UK£12,300 until relatively recently).

Payment of CGT

For share sales / disposals made between:

- 1st January and 30th November, the CGT is payable by 15th December of the same year.

For share / disposals made between:

- 1st December and 31st December, the CGT is payable by 31st January of the following year.

For anyone with a Revenue myAccount service, they can declare and make the payment to Revenue directly this way (or via ROS for those registered this way).

As highlighted earlier, there is an annual tax-free CGT exemption of €1,270 – THIS CANNOT BE CARRIED FORWARD FROM YEAR TO YEAR.

Broker accounts.

A question that can often arise is what happens if the shares are still in a broker account. It doesn’t matter. Where the shares belong to the seller then the taxes are owed and payable!

Speaking of brokers, keep in mind the cost difference between ‘traditional’ brokers and their newer, more nimble rivals. Many so-called ‘traditional’ brokerages can be very expensive, so you need to pay very close attention if you plan to buy and sell shares a lot. However, some new, online brokerages in Ireland can be extremely cost-effective compared to many of the long-established, so-called ‘traditional’ brokerages. Trading fees can wreak havoc on even the best investment strategy where brokers charge regardless of outcome!

Losses on shares in Ireland and offsetting those losses against gains

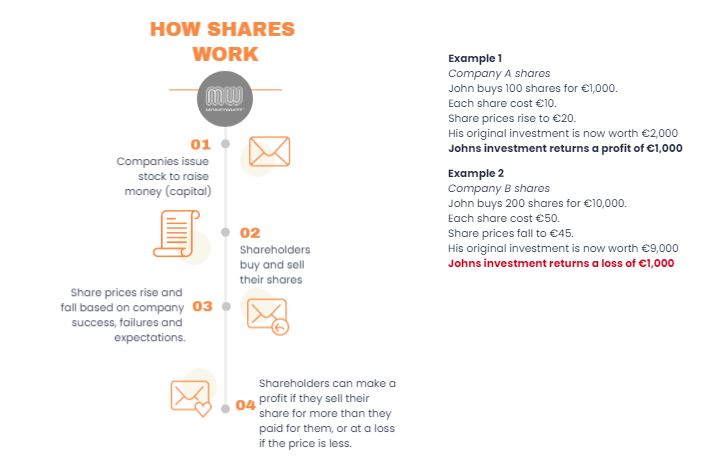

As most people will know, share prices go down and up!

For someone that has shares that have gone down in value, and more importantly, show little sign of recovering, then selling those shares to offset against any gains might be worth exploring.

To do so in a tax efficient manner, the loss-making shares must be disposed of in the same tax year where there is a gain. In the event there is a change in market conditions and that person changes their mind and wish to re-acquire the same shares, they are required to wait for a period of no less than four weeks in order for the loss in value to be realised before re-purchasing them.

Comments are closed.