Putting financial literacy into real-life context

Without putting the benefits of financial literacy into real life context, it could remain nothing more than an abstract, feel-good concept.

Putting financial literacy into context

There is a persistent degree of fear when it comes to money in Ireland. For many, the language that financial advisers use when it comes to everyday financial planning is alienating. Taking pensions as a primary example, there is a vast library of words that describe the same thing. It includes words and terms such as Defined Contribution, Personal Retirement Savings Account, Buyout Bond, Occupational Pension Scheme, Additional Voluntary Contribution, Defined Benefit, Career Average Defined Benefit, Commutation Rate. And there are the acronyms, DC, CADB, PRSA, AVC, PNS, OPS. Its little wonder people are left baffled, confused, and frustrated.

Real financial impact on people’s financial wellbeing

John (not his real name) is aged 65 and close to retirement. He has been saving into a company-sponsored pension scheme which is managed by a well-known brand. Periodically, a representative from the pension company would visit his place of work where employees would be reminded of the many tax benefits of signing up. Nothing wrong with that, Ireland does have a very generous system for investing in a pension.

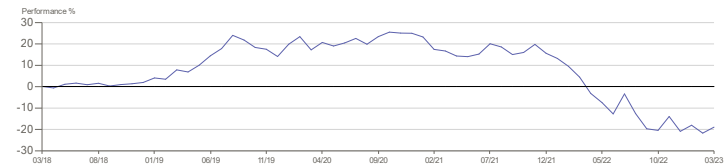

In early 2021, John’s pension fund was valued at about €260,000. This included all of the contributions he made as well as those by his employer.

This week, John’s pension fund was valued at €185,000, a €75,000 drop in value.

He plans to retire in a matter of weeks!

He is very disappointed and trying to figure out what went wrong, or what he should have done differently. He recalls that during his original discussion with the pension expert, the issue of risk was discussed, that his pension fund could be managed in such as way that as he approached retirement, a “lot of risky investments would be removed”, or so that is what he understood.

John’s pension fund is invested through a firm that offers a wide range of pension investment options. For this, John is charged .75% Annual Management Charge (A.M.C.) which is deducted annually and directly from John’s total pension fund. So, despite the precipitous fall in value, John still pays. Over the past 5 years alone, over €8,000 in management fees have been extracted from John’s pension fund. He cannot say what he has received in return other than the regulatory annual statement printout.

One thing John noticed on his pension statement is he ‘self-selected’ his original investments. He also notices an ‘Investment Risk’ graph. The highest risk is ‘7’ and the lowest is ‘1’. His current investments are graded as a ‘4’. John describes himself as “somewhat financially illiterate” and while his current investments turn out to be a ‘Fund of Funds’ with lots of bonds, John is unable to explain what this means. Unfortunately for him, in the last year alone, bonds took a battering.

Financial literacy is not just about understanding financial terminology and products. It is also about having the confidence to challenge others.

For anyone working to provide additional income in retirement, it’s about challenging financial planners, advisors and pension administrators to earn their keep! While the current inflation / investment landscape has taken many seasoned financial experts by surprise, events didn’t unfold overnight, they have grown over the past 24 months or so. Even as far back as mid-2020, the head of the US Federal Reserve announced his team would “tolerate” higher rates of inflation in order to drive economic recovery following the Covid-19 meltdown. In hindsight, it turns out to have been a key moment.

Inflation and interest rates pose enormous risk to both equities and bonds in different ways. And while cash does carry its own risks (especially the impact inflation has on its buying power), capital protection could have been an option especially as John was nearing retirement and he says his natural appetite for risk would be low.

The following graph illustrates the fall in value of that Fund-of-Funds and for John, the money he has lost.

Unfortunately for John, the fall in valuation will have significant implications when it comes to his financial wellbeing in retirement. It can make the difference on what type of health insurance he can afford. Or how often he turns on the heat. Or whether his roof gets fixed this year, next year or not at all! In this context, financial literacy does have some very real implications!

Frank Conway is a Qualified Financial Adviser and author of Ireland’s Essential Guide to Personal Finance. He has developed the Financial Literacy Framework which underpin the national financial literacy campaign.

Comments are closed.