The State is about to radically alter the way it assesses people for the State pension (or the old age pension as most people refer to it). The upcoming changes, which will come into force next month (January 2025) includes a 10-year phase in that will have a dramatic impact on Irish emigrants who returned home in recent years. But the changes will also impact many more returned emigrants that spent just even a short period of time working outside of Ireland.

Case in point. Mary worked in the US for nine-and-a-half years but returned to Ireland almost twenty years ago. She plans to retire in 10 years’ time, just after the 10-year phase in run its course.

When she applies for her State pension, she will have a 30-year work history in Ireland. Under the new pension rules, Mary will receive about 75% of the State pension, which is worth about €15,043 annually today (this is the 2025 figure).

Had the existing rules not been phased out, Mary would have qualified for the full amount.

And to compound Mary’s financial situation, because her period of employment in the US falls just shy of the 10year requirement, she does not qualify for US social security either. This means that Mary’s annual pension entitlement falls from €15,043 (present rules) to €11,282 (new rules or 30/40th of the full rate).

Had she worked for another 6 months in the US, Mary would have qualified for social security there. The amount of social security payments is based on a combination of years of employment and total amount of taxes paid. It caps out at about €3,800 per month and increases each year in line with the prevailing rate of inflation.

All is not lost

Since Mary does not have a full 40-year PRSI record to qualify for the full Irish state pension, she can still apply to have her working credits in the US applied here in Ireland to boost her Irish state pension. To do this, she needs to contact the relevant authorities in both Ireland and the US to ensure that her record of employment in the US is credited in Ireland accurately. Generally, she should begin this process well before her retirement date, to ensure the necessary paperwork is filed, completed, recorded and credited.

Ending of 10-year pension anomaly rule

The existing State pension rules in Ireland allowed for some unusual anomalies and the changes make for greater fairness. One such anomaly was that some individuals, with far fewer PRSI credits were able to qualify for the full State pension when others with a higher number of PRSI credits qualified for less. So, for anyone that may have planned to return to Ireland to work and earn PRSI credits within 10 years of retirement, this loophole is now closed.

Example:

John grew up in Dublin and left the country on his 18th birthday. Now, it his mid-50’s, John wants to return home.

He settles back in Ireland on his 56th birthday. He is a master craftsman and secures full-time employment.

Under the current pension rules, after 10 years, John would have qualified for a full Irish state pension using the existing Yearly Average rule. This means that he would receive 100% of the full €15,043.

But under the new rules, after 10 years of employment, he will receive 25% of the full amount, or about €3,760.

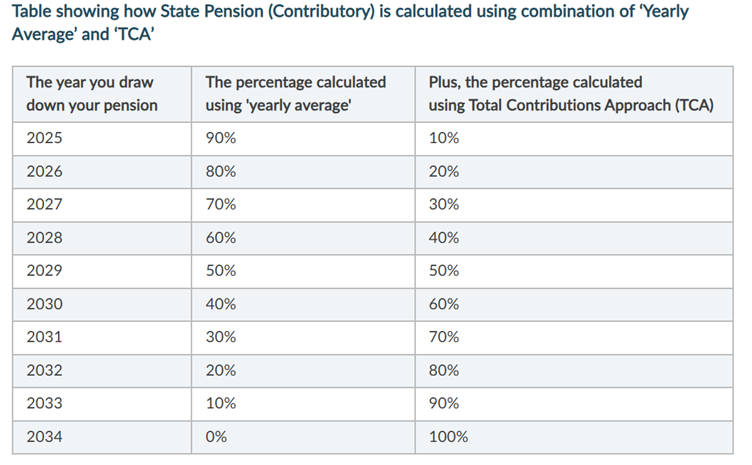

Starting in 2025, a new approach will mean that a 40-year PRSI record will become a lynchpin of how State pension calculations will be carried out.

The calculation table taken from Revenue is as follows:

Asource: Revenue

From 2025, it will be more important than ever anyone with qualifying employment credits abroad take steps to ensure they are included here in Ireland. A list of countries where Ireland has the necessary bi-lateral agreements is published on the Citizens Information website.

MoneyWhizz works with leading employers on a full range of financial wellbeing topics such as claiming back tax, retirement planning and 1:1 financial counselling.

Comments are closed.